ORIGINAL

Understanding AI’s Role in the Banking Industry: A Conceptual Review

Comprender el papel de la IA en el sector bancario: Una revisión conceptual

Danish Anwar1 *, Faizanuddin1 *, Soofia Fatima2 *, Shams Raza3 *, Rajeshwar Dayal4 *

1Post Graduate Department of Commerce & Business Management, Veer Kunwar Singh University, Ara, India

2Faculty of Commerce and Management, Patna Women’s College (Autonomous), Patna University.

3Academic Counselor, IGNOU International Division. India.

4Department of Computer Applications, International School of Management, Patna, India.

Cite as: Anwar D, uddin F, Fatima S, Raza S, Dayal R. Understanding AI’s Role in the Banking Industry: A Conceptual Review. LatIA. 2024; 2:119. https://doi.org/10.62486/latia2024119

Submitted: 25-02-2024 Revised: 10-05-2024 Accepted: 27-08-2024 Published: 28-08-2024

Editor: Dr.

Rubén González Vallejo ![]()

ABSTRACT

This study delves into the shifting role of Artificial Intelligence (AI) within the banking industry, with a focus on its transformative effects on service quality, operational effectiveness, and customer interaction. The research underscores significant developments in AI and its integration, highlighting its pivotal role in updating traditional banking practices and tackling modern-day challenges. It offers a comprehensive analysis of the potential of AI to enhance banking services, while also addressing obstacles such as technical difficulties and regulatory concerns. The outlook section predicts ongoing AI expansion in the banking sector, particularly its capacity to further tailor banking services and improve risk management. The goal of this research is to provide a comprehensive understanding of AI’s integration into Indian banking, shedding light on the evolving relationship between technological innovation and the financial sector.

Keywords: Financial Institutions; Artificial Intelligence; Challenges.

RESUMEN

Este estudio profundiza en el papel cambiante de la Inteligencia Artificial (IA) en el sector bancario, centrándose en sus efectos transformadores sobre la calidad del servicio, la eficacia operativa y la interacción con el cliente. La investigación subraya los avances significativos de la IA y su integración, destacando su papel fundamental en la actualización de las prácticas bancarias tradicionales y en la resolución de los retos actuales. Ofrece un análisis exhaustivo del potencial de la IA para mejorar los servicios bancarios, al tiempo que aborda obstáculos como las dificultades técnicas y los problemas normativos. La sección de perspectivas predice la expansión de la IA en el sector bancario, en particular su capacidad para adaptar aún más los servicios bancarios y mejorar la gestión de riesgos. El objetivo de esta investigación es proporcionar una comprensión global de la integración de la IA en la banca india, arrojando luz sobre la evolución de la relación entre la innovación tecnológica y el sector financiero.

Palabras clave: Instituciones Financieras; Inteligencia Artificial; Retos.

INTRODUCTION

Artificial Intelligence (AI) has emerged as a critical force reshaping the banking sector, driving innovation and modernization across the industry. By integrating cutting-edge AI technologies with long-standing banking operations, financial institutions are entering a new era marked by both remarkable opportunities and significant challenges.(1,2) This fusion of AI with traditional banking practices is revolutionizing the way banks operate, enabling them to streamline processes, enhance customer experiences, and increase overall efficiency. At the same time, this transformation introduces complex hurdles, including the need for technical expertise, regulatory compliance, and the management of evolving risks in an increasingly digital financial ecosystem. The financial industry is undergoing a significant transformation driven by the adoption of new technologies that are redefining traditional banking models. Innovations such as online banking, automated service kiosks, seamless financial integration, and 24/7 availability have reshaped how customers interact with financial services. These advancements have not only streamlined banking operations but have also shifted consumer expectations, making digital banking a vital component of modern financial ecosystems. As a result, the demand for enhanced convenience, speed, and personalization has placed digital platforms at the center of the banking experience, challenging conventional frameworks and prompting institutions to rethink their approach to service delivery. AI is rapidly becoming a critical force in redefining the delivery and consumption of banking services.(3) Several factors are converging to make AI adoption an imperative for financial institutions in today’s rapidly evolving landscape. One of the most pressing drivers is the exponential growth and complexity of financial data that banks must process on a daily basis.(4) Traditional data analysis techniques are no longer sufficient to handle the sophisticated nature of current financial transactions, risk management, and fraud detection.(5) AI’s capacity to analyze vast amounts of data, identifying patterns, anomalies, and trends, makes it an invaluable asset for financial institutions aiming to navigate the challenges of a digital economy.(6) In fact, the integration of AI in banking is not just a technological upgrade but a strategic imperative, as global competition in the financial sector continues to intensify. Banks that fail to adopt AI risk falling behind in efficiency, customer service, and security, ultimately jeopardizing their position in the market.(7,8)

The integration of AI-powered automation plays a crucial role in reducing human errors, significantly strengthening the reliability and efficiency of banking operations [9]. As cyber threats become increasingly sophisticated, the need for banks to adopt advanced AI technologies to bolster security becomes paramount. The evolving nature of these threats demands more intelligent and adaptable defenses.(10) AI-driven cybersecurity solutions offer banks the ability to detect and neutralize threats in real time, keeping them ahead of potential risks and ensuring the protection of sensitive financial data.(11) At its core, the adoption of AI in banking marks a profound shift towards greater operational efficiency, accuracy, and flexibility.(12) AI technologies, such as machine learning and natural language processing, empower banks to process and analyze enormous datasets instantly, uncovering critical insights that enhance decision-making processes.(13) This heightened intelligence not only streamlines operations but also enables banks to offer more tailored and proactive services to customers, ensuring a more engaging and responsive banking experience.(14) As the Indian banking industry navigates its digital transformation journey, the incorporation of AI is becoming a necessity rather than a choice. AI’s diverse contributions—from enhancing security protocols to revolutionizing customer engagement—are positioning it as a pivotal force in the modernization of India’s banking landscape.(15) The intersection of technological innovation and financial services is proving vital for banks, significantly boosting operational efficiency while cultivating an environment that is agile and resilient to ever-changing market conditions.

The ongoing transformation within the banking sector necessitates the integration of technology to maintain and enhance competitiveness. This shift has prompted many traditional institutions to invest heavily in digitizing their processes and leveraging data, which stands as a critical. Projections from Statista (2019) indicate that by 2030, the banking sector in Europe could generate approximately 86 million US dollars from the utilization of Artificial Intelligence (AI). In Spain specifically, a report by Accenture (2019) highlights that 47 % of banking executives believe AI will be the most impactful technology within the next three years. Moreover, a staggering 97 % of these leaders are either considering AI adoption or have already incorporated it into their operations. In figure 1, a graphic showing the commercial value that could be obtained by using AI in the banking industry in the period from 2018 to 2030 is shown.(16)

This study delves into the myriad dimensions of AI within banking sector, exploring current trends and forecasting potential advancements. From strategic decision-making in boardrooms to day-to-day customer interactions, AI’s growing influence is evident. It heralds a new era in which the seamless integration of technology and finance is not merely a passing trend but an essential strategy for ensuring sustainable growth and maintaining competitiveness in an increasingly digitized global economy.

Figure 1. Business value derived from artificial intelligence (AI) in banking industry worldwide from 2019 to 2030

Note: Adapted from Statista, 2019.

Literature Review

Tang and Tien (2020) examine the transformative effects of Artificial Intelligence (AI) on the operations of commercial banks in Vietnam. Their research explores how AI enhances operational efficiency, customer service, and risk management within the banking sector. The study highlights the integration of AI-driven tools, such as machine learning and data analytics, that enable banks to streamline processes, optimize decision-making, and improve fraud detection. Tang and Tien’s work provides valuable insights into the strategic adoption of AI in the financial sector, emphasizing the potential for AI to reshape traditional banking practices and drive future growth in Vietnam’s commercial banks.(17)

Thisarani and Fernando (2021) explore the role of Artificial Intelligence (AI) in shaping the future of banking, emphasizing its transformative potential in revolutionizing financial services. Their paper discusses how AI technologies such as predictive analytics, machine learning, and robotic process automation are driving innovation in banking operations. The authors argue that AI enhances customer personalization, improves risk management, and optimizes operational efficiency. They also highlight AI’s capacity to foster adaptive security frameworks against cyber threats. This study offers a forward-looking perspective, underscoring the strategic importance of AI in ensuring the competitiveness and sustainability of the banking sector.(10)

Shukla and Shamurailatpam (2022) explore the integration of Artificial Intelligence (AI) in Customer Relationship Management (CRM) and its impact on service quality. Their research delves into how AI-driven tools enhance CRM by automating customer interactions, analyzing behavior patterns, and delivering personalized experiences. The paper emphasizes AI’s potential to improve service delivery by optimizing customer support, increasing satisfaction, and driving operational efficiency. Shukla and Shamurailatpam also discuss the implications of AI on long-term customer loyalty, highlighting its role in reshaping modern marketing strategies. Their work provides valuable insights into the strategic role of AI in enhancing both CRM and service quality.(18)

Prentice, Weaven, and Wong (2020) examine the relationship between Artificial Intelligence (AI) performance quality and customer engagement in the hospitality industry. Their study highlights how superior AI performance, characterized by accuracy and responsiveness, positively influences customer interaction and satisfaction. The authors also introduce the concept of “AI preference,” suggesting that a customer’s affinity for AI-driven services can significantly moderate the impact of AI on engagement levels. This research underscores the importance of aligning AI quality with consumer expectations and preferences, offering key insights into optimizing AI deployment to enhance customer experiences in hospitality management.(19)

Manjaly, Varghese, and Varughese (2021) critically analyze the impact of Artificial Intelligence (AI) on the banking sector, focusing on its transformative potential across various banking operations. The authors explore AI’s role in enhancing decision-making, risk management, and customer service while addressing the challenges of integrating AI into traditional banking frameworks. They discuss both the opportunities and concerns, such as ethical considerations and the need for regulatory oversight. Their study provides a comprehensive evaluation of AI’s role in reshaping banking processes, emphasizing its importance for future growth and competitiveness within the financial industry.(20)

AI in Banking: A Global Overview

The global banking industry has experienced a profound shift with the emergence of Artificial Intelligence (AI). AI technologies have transformed traditional banking operations by introducing advanced capabilities such as automation, predictive analytics, and personalized customer service. This ongoing digital transformation has opened new avenues for growth, operational efficiency, and customer engagement while presenting unique challenges related to security, regulation, and integration. The rapid advancement of AI has positioned it as a crucial driver of innovation and competitiveness in the global financial sector. AI adoption in banking began as a tool for improving operational efficiency, primarily through the automation of repetitive tasks. However, its role has expanded significantly. Today, AI is integrated into various banking functions, from risk management and fraud detection to customer relationship management and personalized financial services. AI technologies such as machine learning, natural language processing (NLP), and robotic process automation (RPA) are transforming the core functions of banks, enabling them to provide faster, more accurate, and tailored services to their customers. A recent study by Chan et. al, (2022) highlights AI’s impact on banks worldwide, noting that it improves decision-making processes by analyzing large datasets with greater speed and accuracy than traditional methods.(21) This ability is particularly valuable in areas like credit scoring, where AI can assess a borrower’s risk in real-time by analyzing a broad range of data points, including transaction history, social behavior, and economic trends.

AI’s Role in Enhancing Security and Fraud Detection

One of the most critical applications of AI in banking is its ability to enhance security and fraud detection. AI’s advanced algorithms can detect patterns of abnormal behavior, allowing banks to identify potential fraud before it escalates. Zeadally et al. (2020) emphasize that AI-driven cybersecurity solutions provide real-time threat detection, offering banks a proactive approach to combat evolving cyber threats.(11)

The incorporation of AI in this domain has been particularly beneficial in regions where digital banking has rapidly expanded, such as Southeast Asia and Africa. These regions, while experiencing fast adoption of mobile and online banking, are also vulnerable to sophisticated cyber-attacks. AI has helped mitigate these risks by using predictive models that can anticipate potential security breaches based on historical data.

AI-Powered Customer Service and Personalization

AI is also revolutionizing customer service in banking. AI-powered chatbots, for example, have become an essential part of many banks’ customer engagement strategies. These chatbots can handle basic customer queries 24/7, significantly reducing wait times and operational costs. According to research by Niu, et al. (2024), the use of chatbots has enhanced customer satisfaction by offering quick and accurate responses to inquiries, thereby freeing human agents to handle more complex issues.(22) Furthermore, AI’s ability to personalize services has greatly improved the customer experience. Machine learning algorithms can analyze individual customer behavior and financial habits to offer tailored products and services. Banks in the United States, Europe, and Asia are using AI to recommend investment portfolios, suggest savings strategies, and offer personalized loan packages. This level of personalization not only improves customer satisfaction but also increases customer retention and loyalty.

Impact on Banking Operations

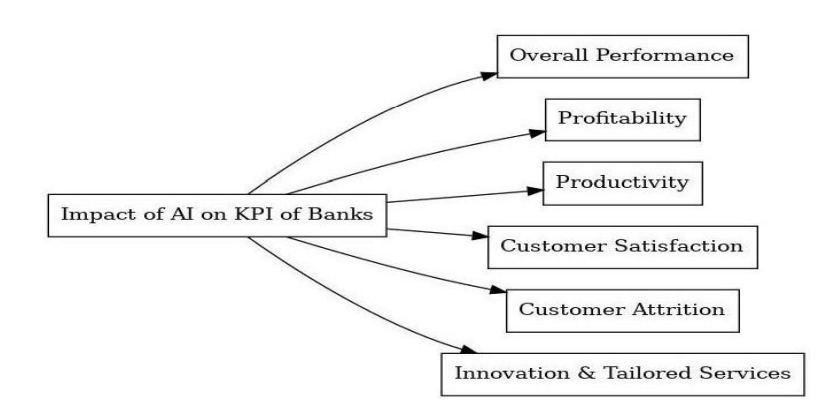

The incorporation of Artificial Intelligence (AI) into the banking industry marks the beginning of a transformative era characterized by enhanced operational efficiency and a stronger focus on customer-centric services. This integration has significantly influenced crucial Key Performance Indicators (KPIs) that are vital to a bank’s success and expansion.(23) AI’s ability to streamline operations has the potential to greatly improve banks’ overall performance by boosting efficiency, minimizing operational costs, and driving revenue growth through more accurate customer targeting and service optimization. Moreover, AI facilitates the development of innovative financial products and services, positioning banks for sustainable future growth.

Figure 2. Impact of AI on KPI of Banks(24)

Overall Performance

Artificial Intelligence (AI) significantly enhances overall performance by boosting efficiency, refining decision-making, and optimizing strategic planning. AI systems have the capability to sift through extensive datasets, uncover patterns, forecast future outcomes, and offer actionable insights. This analytical power enables banks to enhance their operational effectiveness and make more informed decisions. By leveraging AI technologies, banks can achieve greater precision in predicting trends and outcomes, leading to more effective strategies and improved overall performance.(25)

Profitability

The integration of Artificial Intelligence (AI) into banking systems has the potential to significantly boost profitability by optimizing various critical functions. AI enables more precise pricing strategies, tailored to market conditions and customer behaviors, while personalizing marketing efforts to drive increased sales. Furthermore, AI’s sophisticated algorithms enhance fraud detection by identifying suspicious patterns, thereby reducing financial losses. Additionally, AI improves risk management by providing real-time data analysis and predictive modeling, allowing banks to make informed decisions and mitigate potential risks effectively. These advancements collectively contribute to the financial health and profitability of modern banking institutions.(17)

Customer Satisfaction

Artificial Intelligence (AI) plays a pivotal role in enhancing customer satisfaction by delivering personalized services tailored to individual needs. Through AI-driven insights, banks can offer customized financial solutions that resonate with customers’ unique preferences. Additionally, AI enables rapid responses to customer inquiries, ensuring prompt service delivery and reducing wait times. Intelligent chatbots, powered by natural language processing, provide 24/7 customer support, handling routine questions and concerns efficiently. This continuous availability and responsiveness not only improve user experience but also strengthen customer loyalty and engagement by providing consistent and high-quality interactions.

Customer Attrition

Artificial Intelligence (AI) has a significant role in curbing customer attrition by identifying early indicators of dissatisfaction and enabling banks to take proactive measures. By analyzing behavioral patterns and transactional data, AI can accurately predict which customers are at risk of leaving, allowing banks to address their concerns before they make the decision to exit. Additionally, AI enhances customer engagement through personalized offers and interactions, catering to individual needs and preferences. This level of customization not only improves customer satisfaction but also fosters stronger relationships, making clients more likely to remain loyal to the bank.(19)

Innovation & Tailored Services

Artificial Intelligence (AI) is a catalyst for innovation within the banking sector, driving the discovery of new business opportunities and refining service delivery models. By leveraging advanced analytics, AI can identify emerging trends and market demands, positioning banks to capitalize on untapped opportunities. Additionally, AI’s ability to personalize services based on individual customer preferences enhances the overall customer experience. This level of customization not only improves satisfaction but also fosters long-term loyalty, as clients feel more connected to services that reflect their unique needs and expectations. Consequently, AI plays a pivotal role in both innovation and customer retention.(24)

Challenges and Future Directions

Despite its numerous benefits, the integration of AI in the banking sector is not without challenges. One significant issue is the regulatory landscape, which is still catching up with the rapid pace of AI innovation. As AI systems are increasingly used for decision-making, concerns regarding transparency, bias, and accountability have emerged. According to a 2021 report by Firsanova, regulatory bodies across the globe are working to establish frameworks that ensure AI-driven systems operate within ethical and legal boundaries. Another challenge is the need for skilled professionals who can manage and maintain AI systems. The shortage of AI expertise, particularly in developing countries, can hinder the widespread adoption of AI in banking. As noted, banks must invest in both technology and talent to fully leverage AI’s potential. Looking ahead, the future of AI in banking will likely focus on further refining personalization, security, and operational efficiency. Advances in quantum computing could offer new possibilities for AI in financial modeling and risk analysis. Additionally, as AI becomes more integrated into the fabric of banking, there will be a growing emphasis on ethical AI practices, ensuring that these technologies are used responsibly and fairly.

CONCLUSION

In conclusion, the evolution of Artificial Intelligence (AI) within the banking sector exemplifies the transformative power of technology in redefining conventional banking frameworks. As the industry embraces this digital revolution, AI has proven to be more than just a means of enhancing operational efficiency and driving growth. It signifies a shift towards a more inclusive, resilient, and customer-centric banking landscape. The integration of AI heralds a future where banks can offer more tailored, adaptive services while fostering stronger connections with their clients, ensuring the sector’s adaptability and success in a rapidly changing world. The emergence of AI in the global banking sector represents a significant technological leap that is reshaping the industry. From improving operational efficiency and customer service to enhancing security and personalization, AI offers a range of benefits that are helping banks remain competitive in an increasingly digital world. However, challenges such as regulatory concerns and the need for skilled professionals must be addressed to fully realize AI’s potential in banking. As AI continues to evolve, it will undoubtedly play a central role in shaping the future of banking worldwide.

REFERENCES

1. D. N. P. Md. Alimul Haque, Shameemul Haque, Samah Alhazmi, Artificial Intelligence and Covid-19: A Practical Approach. Bentham Science Publisher, 2022. doi: 10.2174/9879815079180122010010.

2. V. Whig, B. Othman, A. Gehlot, M. A. Haque, S. Qamar, and J. Singh, “An Empirical Analysis of Artificial Intelligence (AI) as a Growth Engine for the Healthcare Sector,” in 2022 2nd International Conference on Advance Computing and Innovative Technologies in Engineering (ICACITE), IEEE, 2022, pp. 2454–2457.

3. A. K. Tiwari and D. Saxena, “Application of Artificial Intelligence in Indian Banks,” in 2021 International Conference on Computational Performance Evaluation (ComPE), IEEE, 2021, pp. 545–548.

4. M. C. M. Lee, H. Scheepers, A. K. H. Lui, and E. W. T. Ngai, “The implementation of artificial intelligence in organizations: A systematic literature review,” Inf. Manag., vol. 60, no. 5, p. 103816, 2023.

5. J. A. Tenreiro Machado, “A fractional perspective to financial indices,” Optimization, vol. 63, no. 8, pp. 1167–1179, 2014.

6. C. Ayadurai and S. Joneidy, “Artificial Intelligence and Bank Soundness: Between the Devil and the Deep Blue Sea-Part 2,” Oper. Manag. Trend Digit. Era, 2021.

7. K. K. and N. K. S. Md Alimul Haque, Shameemul Haque, Digital Transformation and Challenges to Data Security and Privacy. in Advances in Information Security, Privacy, and Ethics. IGI Global, 2021. doi: 10.4018/978-1-7998-4201-9.

8. A. Prakash, A. Haque, F. Islam, and D. Sonal, “Exploring the Potential of Metaverse for Higher Education: Opportunities, Challenges, and Implications,” Metaverse Basic Appl. Res., vol. 2, no. SE-Reviews, p. 40, Apr. 2023, doi: 10.56294/mr202340.

9. A. K. Singh, P. M. Sharma, M. Bhatt, A. Choudhary, S. Sharma, and S. Sadhukhan, “Comparative analysis on artificial intelligence technologies and its application in fintech,” in 2022 International Conference on Augmented Intelligence and Sustainable Systems (ICAISS), IEEE, 2022, pp. 570–574.

10. M. Thisarani and S. Fernando, “Artificial intelligence for futuristic banking,” in 2021 IEEE International Conference on Engineering, Technology and Innovation (ICE/ITMC), IEEE, 2021, pp. 1–13.

11. S. Zeadally, E. Adi, Z. Baig, and I. A. Khan, “Harnessing artificial intelligence capabilities to improve cybersecurity,” Ieee Access, vol. 8, pp. 23817–23837, 2020.

12. M. A. Haque et al., “Achieving Organizational Effectiveness through Machine Learning Based Approaches for Malware Analysis and Detection,” Data Metadata, vol. 2, p. 139, 2023.

13. M. A. Hossain et al., “AI-enabled approach for enhancing obfuscated malware detection: a hybrid ensemble learning with combined feature selection techniques,” Int. J. Syst. Assur. Eng. Manag., 2024, doi: 10.1007/s13198-024-02294-y.

14. D. N. Kaur, S. L. Sahdev, D. M. Sharma, and L. Siddiqui, “Banking 4.0:‘the influence of artificial intelligence on the banking industry & how ai is changing the face of modern day banks,’” Int. J. Manag., vol. 11, no. 6, 2020.

15. R. T. Salunkhe, “Role of artificial intelligence in providing customer services with special reference to SBI and HDFC Bank,” Int. J. Recent Technol. Eng., vol. 8, no. 4, pp. 12251–12260, 2019.

16. C. Gallego-Gomez and C. De-Pablos-Heredero, “Artificial intelligence as an enabling tool for the development of dynamic capabilities in the banking industry,” Int. J. Enterp. Inf. Syst., vol. 16, no. 3, pp. 20–33, 2020.

17. S. M. Tang and H. N. Tien, “Impact of artificial intelligence on vietnam commercial bank operations,” Int. J. Soc. Sci. Econ. Invent., vol. 6, no. 07, pp. 296–303, 2020.

18. P. Shukla and S. D. Shamurailatpam, “Conceptualizing the Use of Artificial Intelligence in Customer Relationship Management and Quality of Services: A Digital Disruption in the Indian Banking System,” in Adoption and Implementation of AI in Customer Relationship Management, IGI Global, 2022, pp. 177–201.

19. C. Prentice, S. Weaven, and I. A. Wong, “Linking AI quality performance and customer engagement: The moderating effect of AI preference,” Int. J. Hosp. Manag., vol. 90, p. 102629, 2020.

20. J. Manjaly, R. M. Varghese, and P. Varughese, “Artificial Intelligence in the Banking Sector—A Critical Analysis,” Shanlax Int. J. Manag., vol. 8, no. S1, pp. 210–216, 2021.

21. L. Chan, L. Hogaboam, and R. Cao, Applied artificial intelligence in business. Springer, 2022.

22. B. Niu and G. F. N. Mvondo, “I Am ChatGPT, the ultimate AI Chatbot! Investigating the determinants of users’ loyalty and ethical usage concerns of ChatGPT,” J. Retail. Consum. Serv., vol. 76, p. 103562, 2024.

23. A. Mehrotra, “Artificial intelligence in financial services–need to blend automation with human touch,” in 2019 International Conference on Automation, Computational and Technology Management (ICACTM), IEEE, 2019, pp. 342–347.

24. J. Ng and S. Shah, Hands-On Artificial Intelligence for Banking: A practical guide to building intelligent financial applications using machine learning techniques. Packt Publishing Ltd, 2020.

25. T. R. Yu and X. Song, “Big data and artificial intelligence in the banking industry,” in Handbook of financial econometrics, mathematics, statistics, and machine learning, World Scientific, 2021, pp. 4025–4041.

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHOR CONTRIBUTIONS

Conceptualization: Danish Anwar, Faizanuddin, Soofia Fatima, Shams Raza, Rajeshwar Dayal.

Investigation: Danish Anwar, Faizanuddin, Soofia Fatima, Shams Raza, Rajeshwar Dayal.

Methodology: Danish Anwar, Faizanuddin, Soofia Fatima, Shams Raza, Rajeshwar Dayal.

Writing - original draft: Danish Anwar, Faizanuddin, Soofia Fatima, Shams Raza, Rajeshwar Dayal.

Writing - review and editing: Danish Anwar, Faizanuddin, Soofia Fatima, Shams Raza, Rajeshwar Dayal.